Florida Real Estate Weekly Snapshot June 15, 2020

June 22, 2020

The Metro Orlando Defense Task Force is facilitating a coordinated regional response to guidelines set by the U.S. Air Force for the selection of a permanent location for U.S. Space Command headquarters. Currently based in Colorado, SPACECOM’S new headquarters site selection process begins this summer and the announcement of the final selection is expected in January 2021. Orlando is well positioned for this opportunity as it has been the epicenter of the U.S.-led space race for over 60 years now.

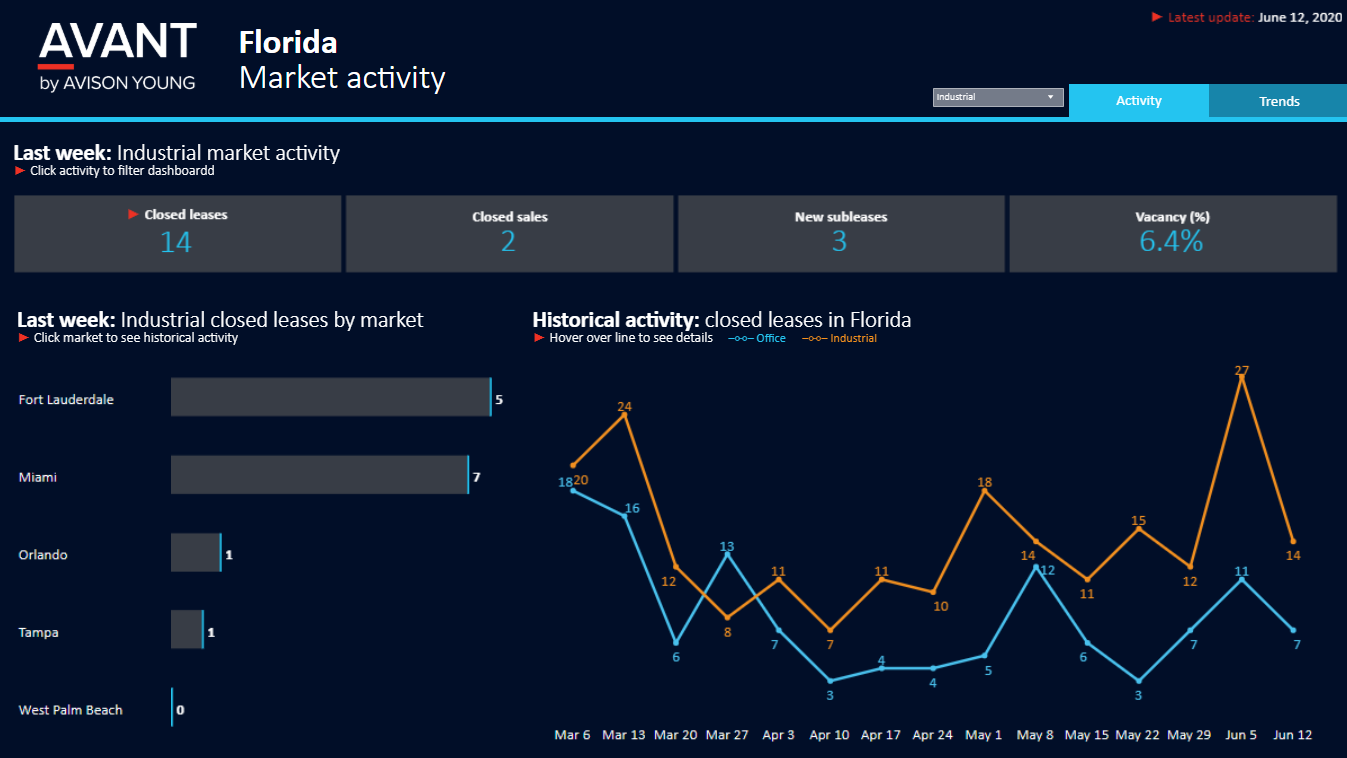

Government relief packages over the last 90 days have likely inflated rent collections. Office and industrial rent collections for Florida-based tenants are experiencing an uptick, which may be due to the PPP finally coming through for many. The number of tenants still able to maintain obligations once they come off economic life support is yet to be determined.

Pent-up capital continues to wait on the sidelines for deeply discounted deals on distressed assets. For example, Oaktree Capital Management is currently raising a $15 billion fund for distressed assets. There is also a large amount of patient, long-term capital looking for strategic long-term value opportunities.

The bid/ask standoff continues as investors are pushing the future distress narrative once government subsidies taper off, however property owners are showing strength through strong rent collections, and for the most part solid property fundamentals. It’s only a matter of time until the dust settles and investors return at close to pre-pandemic pricing.

In the industrial market, warehouse space with a freezer/cooler component continues to be sought after. There are currently several e-commerce and food and beverage tenants with space requirements of 150,000 sf and greater actively searching in the Miami industrial market.

COVID-19 continues to take a toll on the retail market, with the biggest news last week involving Simon Property Group’s decision to walk away from a $3.6 billion deal to buy Taubman Centers and its portfolio of luxury mall properties. Taubman’s Florida properties include Mall at Millennia in Orlando, Mall at University Town Center in Sarasota, Waterside Shops in Naples, The Gardens Mall in Palm Beach Gardens, and Miami World Center and Dolphin Mall in Miami. While the pandemic has hastened the death of some retailers, it has also fueled growth in new ones like Brandy Melville and Amazon’s new 4-star retail concept.

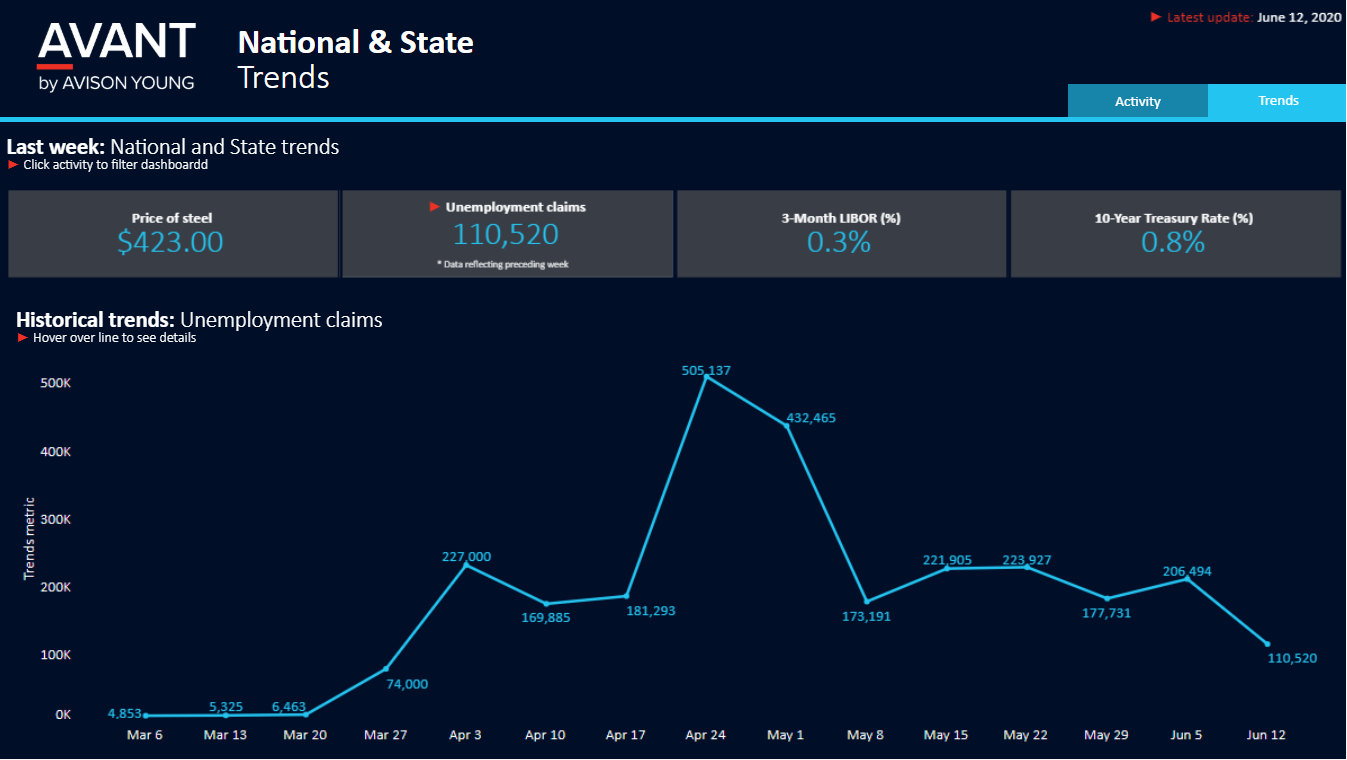

According to the National Multifamily Housing Council, nearly 80% of residential tenants in the U.S. paid rent during the first week of June. These stronger than expected rent payments are also likely bolstered by employment benefits and one-time relief payments made through the CARES Act.

While travel industry losses in the U.S. are expected to result in a GDP impact of $1.2 trillion in 2020, travel spending grew for the sixth consecutive week in the week ending June 6th, marking its highest level since March. The year-over-year change in weekly travel spending in Florida for the week ending May 30th was -81% for the second week straight at -$1.76 billion. The year-over-year change in weekly state tax revenue was -$51 million.