The Avison Young Fort Lauderdale office provides commercial real estate services to property owners, investors and occupiers

Avison Young is one of the top providers of integrated commercial real estate services in Fort Lauderdale. With offices located across Florida, our commercial real estate advisors offer full market coverage to best serve our clients regardless of location. Avison Young offers a diverse group of senior real estate professionals who possess substantial bench strength in capital markets, leasing, project management and property management.

Avison Young is a global real estate advisor built to create real economic, social, and environmental value, powered by – and for, people. We believe there is a vital role for our sector in creating healthy, productive workplaces for employees; cities that are centers of prosperity for its citizens; and built spaces and places that create a net benefit to the economy, the environment and the community. Our people organize around our clients’ opportunities and work as colleagues to focus on their success.

Fort Lauderdale commercial real estate services

Avison Young’s brokerage team in Fort Lauderdale has consistently completed major leasing and investment sales transactions across all asset types. We’ve worked on the behalf of tenants, landlords, investors, vendors and buyers alike, including many large national and international corporate clients.

Whether you are an owner, investor, occupier or developer, we deliver results aligned with your strategic business objectives. Our Fort Lauderdale commercial real estate advisors are here to support your initiatives, add value, and build a competitive advantage for your organization.

Find Fort Lauderdale properties for sale or lease

Search Avison Young’s Fort Lauderdale commercial real estate listings for sale and lease to find the right commercial property for you. Our investment and leasing opportunities include office, industrial, warehouse, retail, multi-family and land properties. We also offer specialized spaces for healthcare, automotive and more.

-

Twin Peaks STNL

440 Southwest 145th AvenuePembroke Pines, FL 33027For Sale

Retail

-

1 E Broward BlvdFort Lauderdale, FL 33301

1 E Broward BlvdFort Lauderdale, FL 33301For Lease

Office

-

Broward Financial Centre

500 E Broward BlvdFort Lauderdale, FL 33301For Lease

Office

-

595 Financial Center - 595 Tower

595 Federal HwyBoca Raton, FL 33432For Lease

Office

-

Sawgrass Commerce Center - Building B

14050 NW 14th StreetSunrise, FL 33323For Lease

Office

-

The Plaza at Las Olas - 301 Building

301 East Las Olas BlvdFort Lauderdale, FL 33301For Lease

Office

-

North 40 - 5201 Building

5201 Congress AveBoca Raton, FL 33487For Lease

Office

-

Weston Corporate Campus - Building II

2002 Ultimate WayWeston, FL 33326For Lease

Office

Florida commercial real estate news

-

Avison Young taps Lisa Jesmer as Florida Market LeaderApril 1, 2024

Avison Young taps Lisa Jesmer as Florida Market LeaderApril 1, 2024 -

Avison Young closes $9M sale of 25,482-square-foot office building in Weston, FloridaMarch 12, 2024

Avison Young closes $9M sale of 25,482-square-foot office building in Weston, FloridaMarch 12, 2024 -

Avison Young to lease Park 4 Logistics Center, a new 860k-square-foot industrial project under development by Clarion Partners and Seefried Industrial Properties fronting I-4 in Plant City, FloridaFebruary 15, 2024

Avison Young to lease Park 4 Logistics Center, a new 860k-square-foot industrial project under development by Clarion Partners and Seefried Industrial Properties fronting I-4 in Plant City, FloridaFebruary 15, 2024 -

Avison Young completes 23,321 square feet of law firm office leases in Coral Gables, FloridaJanuary 25, 2024

Avison Young completes 23,321 square feet of law firm office leases in Coral Gables, FloridaJanuary 25, 2024

Fort Lauderdale commercial real estate insights

Unemployment rates dropping, a statewide open-for-business attitude, and additional market dynamics show a promising future for the Fort Lauderdale and industrial markets.

-

Flight to quality continues to drive asking rent growth in Fort Lauderdale’s office market

Flight to quality continues to drive asking rent growth in Fort Lauderdale’s office market -

.png/c76d9334-6e32-bab8-c57c-558b7b9b6f9d?t=1709222233513) How are CRE loan maturities changing over the next five years in Fort Lauderdale?

How are CRE loan maturities changing over the next five years in Fort Lauderdale? -

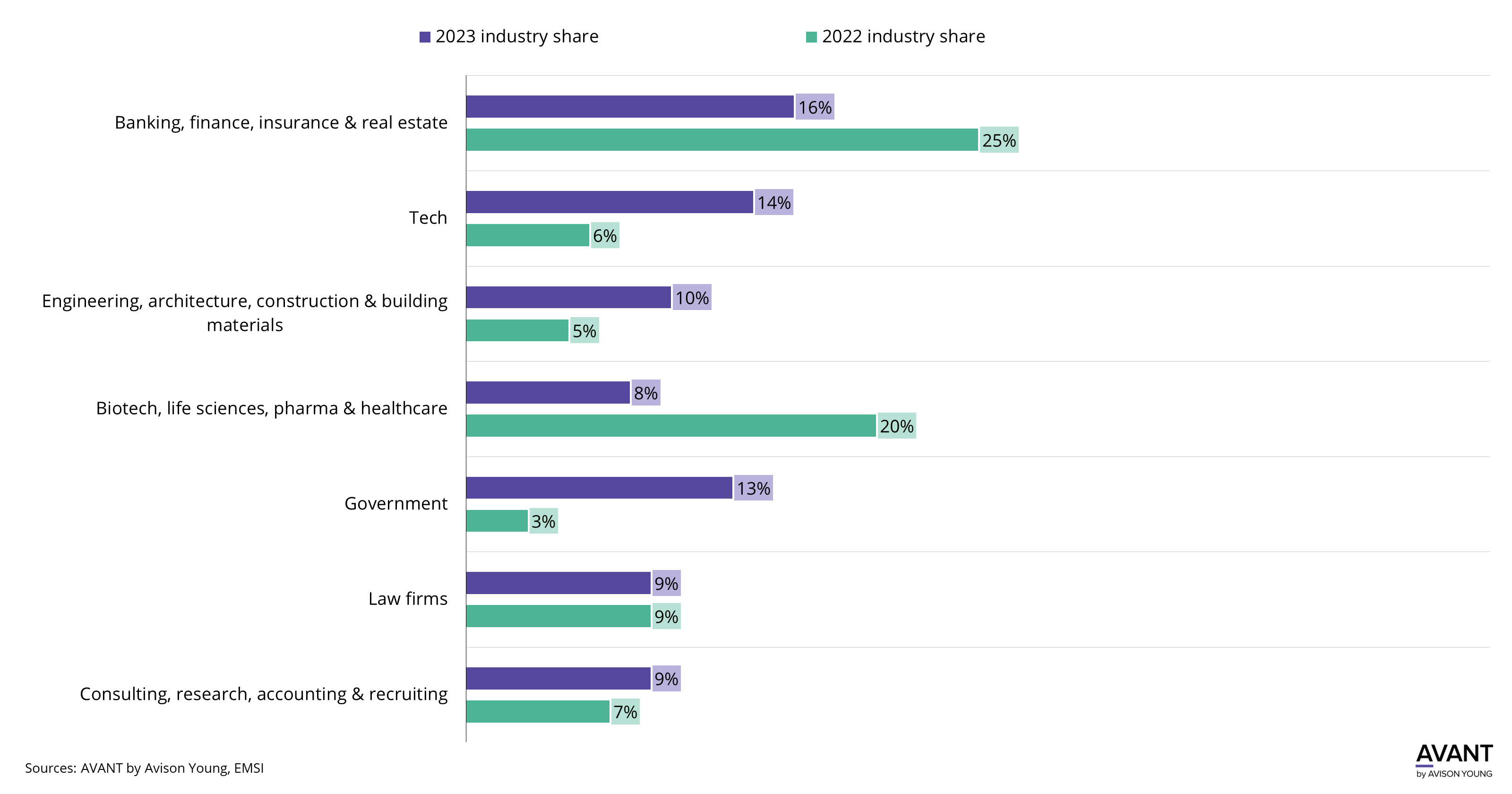

How did office tenant demand in Fort Lauderdale shift from 2022 to 2023?

How did office tenant demand in Fort Lauderdale shift from 2022 to 2023? -

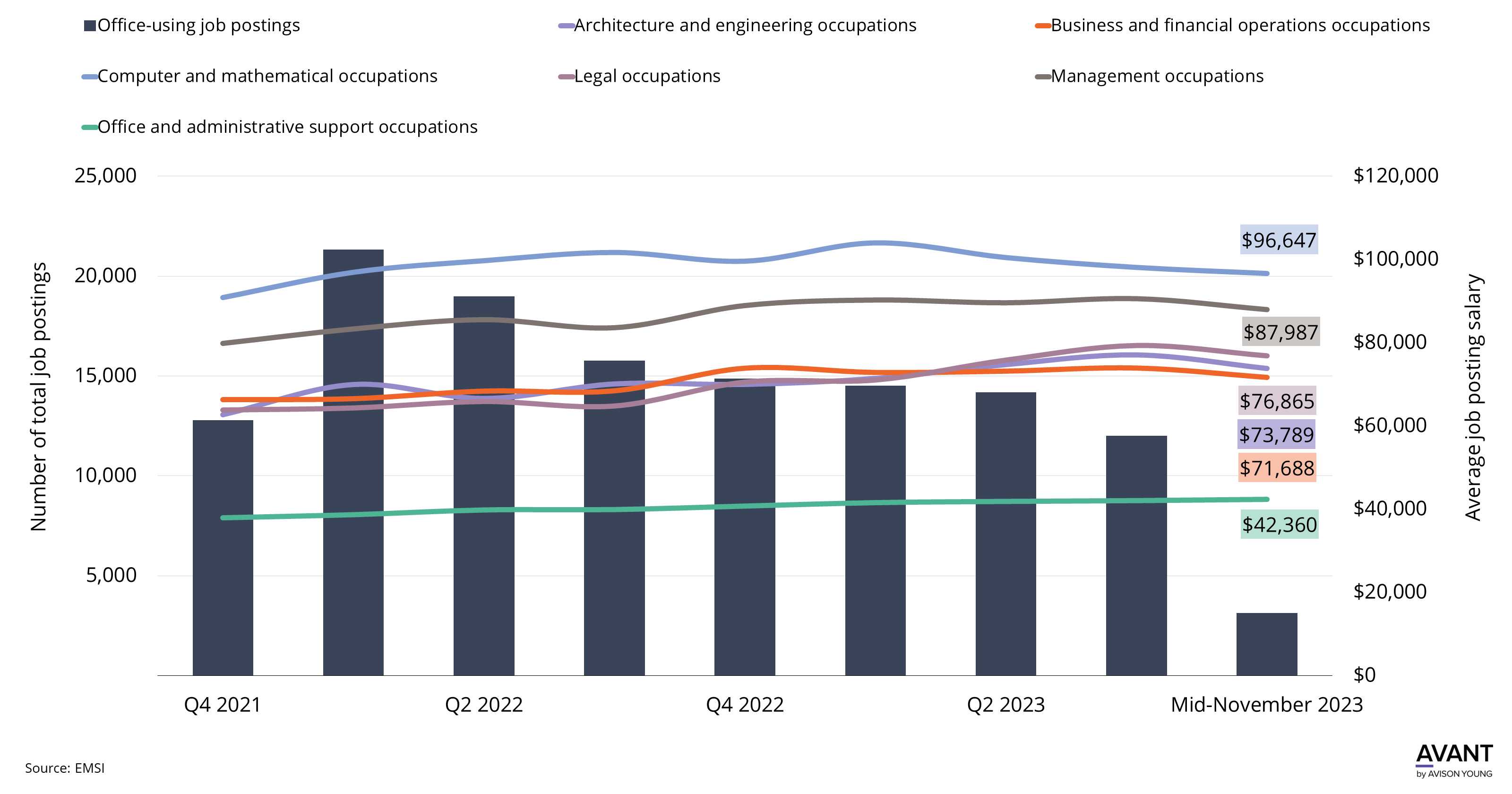

How does the number of office job postings in Fort Lauderdale compare to salary growth?

How does the number of office job postings in Fort Lauderdale compare to salary growth?

Fort Lauderdale commercial real estate consultants

Real Estate Management Services, Florida

Principal, Director - Real Estate Management Services

Fort Lauderdale office

Fort Lauderdale Managing Director

Contact a commercial real estate advisor in Fort Lauderdale

Our commercial real estate brokers and advisors leverage data-driven intelligence paired with deep Fort Lauderdale knowledge. Connect with us to discuss how we can help you drive more value from your assets.